aurora co sales tax rate 2021

You can print a 9225 sales tax table here. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51.

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

24 lower than the maximum sales tax in CO.

. Updated 12021 Effective July 1 2006 the Scientific and Cultural facilities District CD of 010 consists of. The Colorado sales tax rate is currently. Friday January 01 2021.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. There is no applicable special tax. The December 2020 total local sales tax rate was also 8000.

4 Sales tax on food liquor for immediate consumption. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. With CD 290 000 010 025 375.

Rates include state county and city taxes. Wayfair Inc affect Colorado. What is the sales tax rate in Aurora Colorado.

Paul Dillman Created Date. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

Aurora has a higher sales tax than 886 of Colorados other cities and counties. The Colorado sales tax rate is currently. 2022 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

24 lower than the maximum sales tax in CO. Sales Use Tax Rate Changes Effective July 1 2022. You can find more tax rates and allowances for Aurora and Colorado in the 2022 Colorado Tax Tables.

Aurora-RTD 290 100 010 025 375. Aurora-RTD 290 100 010 025 375. This is the total of state and county sales tax rates.

Effective December 31 2011 the Football District salesuse tax of 010 expired within Arapahoe County. State Local Sales Tax Rates As of January 1 2021. Note that the State of Colorado has enacted the same clarification.

Integrate Vertex seamlessly to the systems you already use. Did South Dakota v. The latest sales tax rates for cities in Colorado CO state.

Groceries are exempt from the Aurora and Colorado state sales taxes. B Three states levy mandatory statewide local add-on sales taxes at the state level. Aurora CO Sales Tax Rate.

The County sales tax rate is. Boulder CO Sales Tax Rate. These rates are weighted by population to compute an average local tax rate.

So whilst the Sales Tax Rate in Colorado is 29 you can actually pay anywhere between 29 and 10 depending on the local sales tax rate applied in the. The Arapahoe County sales tax rate is. For tax rates in other cities see Colorado sales taxes by city and county.

The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. This is the total of state county and city sales tax rates.

Aurora Sales Tax Rates for 2022. 2020 rates included for use while preparing your income tax deduction. To find all applicable sales or use tax rates for a specific business location or local government visit the How to Look Up Sales Use Tax Rates web page.

2021 Final Property Tax Bills. Commercial Payment In Lieu General Rate - Excess Land. This page does not contain all tax rates for a business location.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. This web page contains changes to existing sales or use tax rates. This clarification is effective on June 1 2021.

2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. 5312021 11625 PM. Aurora Sales Tax Rates for 2022.

Residential Property Tax Rate for Aurora from 2018 to 2021. The minimum combined 2022 sales tax rate for Arapahoe County Colorado is. The December 2020 total local sales tax rate was also 8000.

Avalara AvaTax plugs into popular business systems to make sales tax easier to manage. The minimum combined 2022 sales tax rate for Aurora Colorado is 8. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. A City county and municipal rates vary. Wayfair Inc affect Colorado.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. The Colorado state sales tax rate is currently.

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. This is the total of state county and city sales tax rates. TAX CLASS TAX CODES.

The current total local sales tax rate in Aurora CO is 8000. Note that failure to. The current total local sales tax rate in Aurora CO is 8000.

The Aurora sales tax rate is. 2021 PROPERTY TAX RATES. California 1 Utah 125 and Virginia 1.

0375 lower than the maximum sales tax in MO. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Form 8071 Effective Starting October 1 2021 Present.

And Seattle Washingtonare tied for the second highest rate of 1025 percent. You can print a 85 sales tax table here. The minimum combined 2022 sales tax rate for Aurora Colorado is.

The Aurora Cd Only Sales Tax is collected by the merchant on. Brighton CO Sales Tax Rate. For tax rates in other cities see Missouri sales taxes by city and county.

You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. The 2018 United States Supreme Court decision in South Dakota v. Aurora collects a 56 local sales tax the maximum local sales tax allowed under Colorado law.

Has impacted many state nexus laws and sales. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

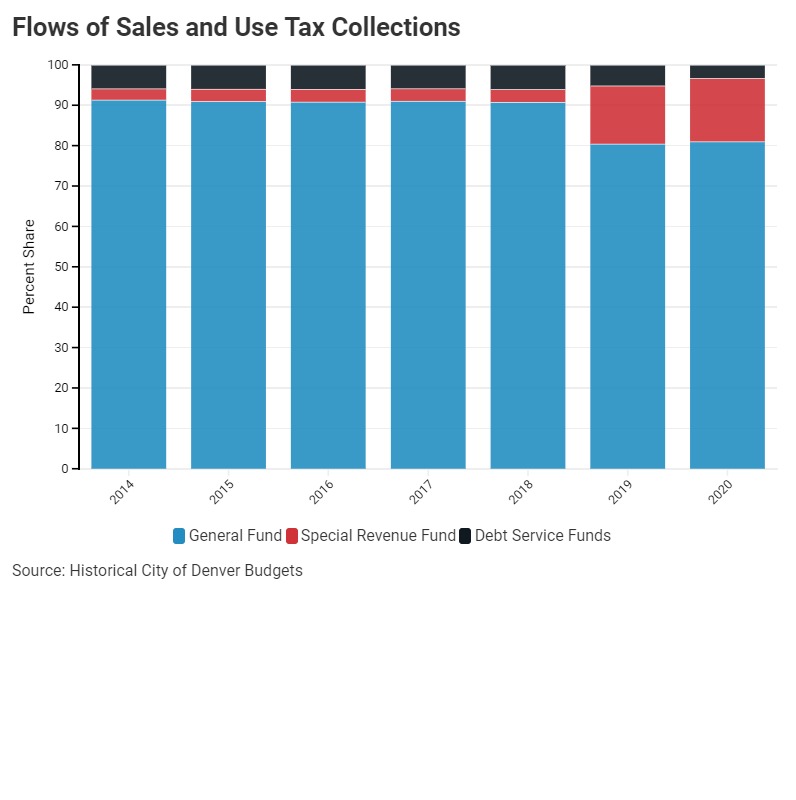

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Sales Tax By State Is Saas Taxable Taxjar

Nebraska Sales Tax Rates By City County 2022

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Colorado Sales Tax Rates By City County 2022

Utah Sales Tax Rates By City County 2022

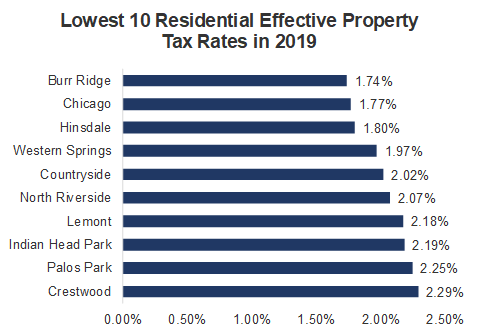

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Is Food Taxable In Colorado Taxjar

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver